Market Movement – May 25, 2020

|

||

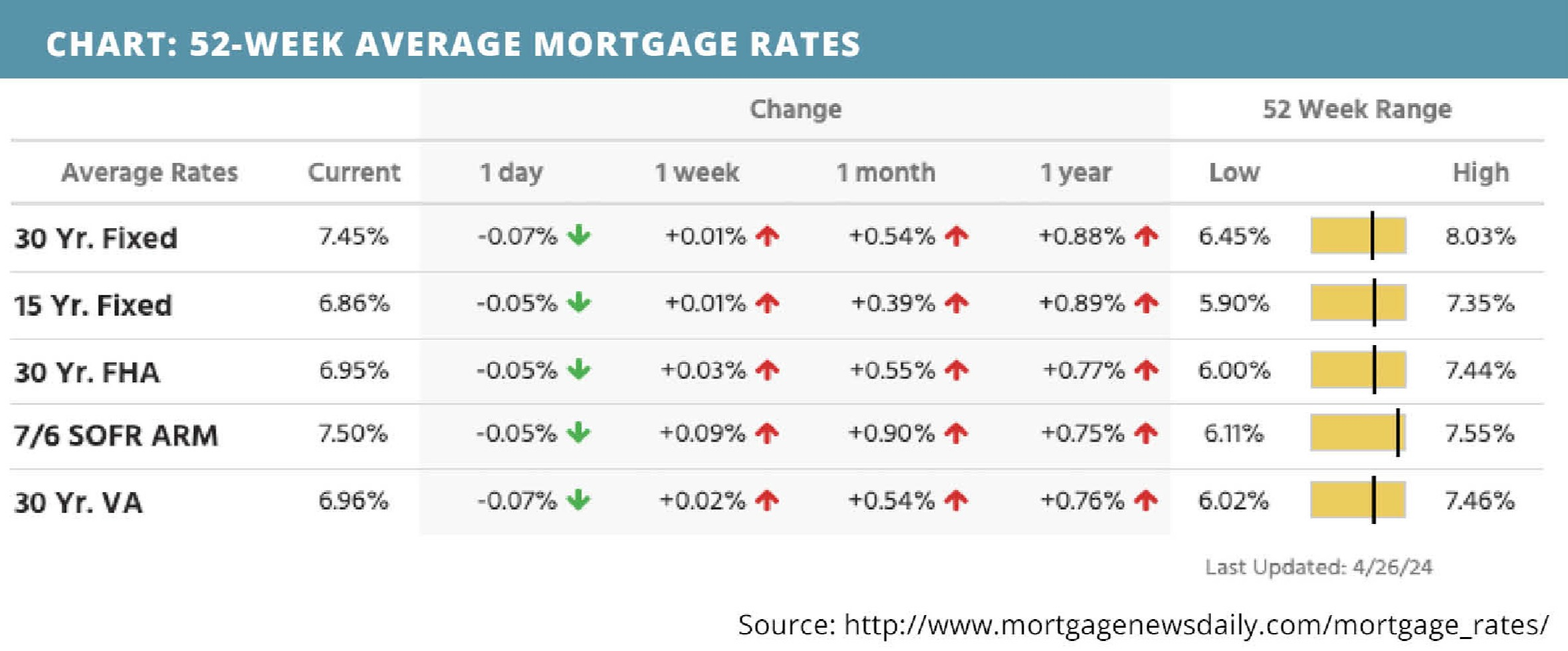

| Mortgage rates trended lower this week and continue to hover historic lows. Home builder sentiment rebounded after a record drop the previous month. Housing starts and building permits each declined. New purchase mortgage application submissions increased but refinance mortgage application submissions declined. The Federal Open Market Committee released the minutes from its previous meeting. Jobless claims continue to reflect widespread layoffs and furloughs. Existing home sales declined, as expected. | ||

|

MORTGAGE RATES CURRENTLY TRENDING

THIS WEEK’S POTENTIAL VOLATILITY

|

||

|

||

|

||

|

||

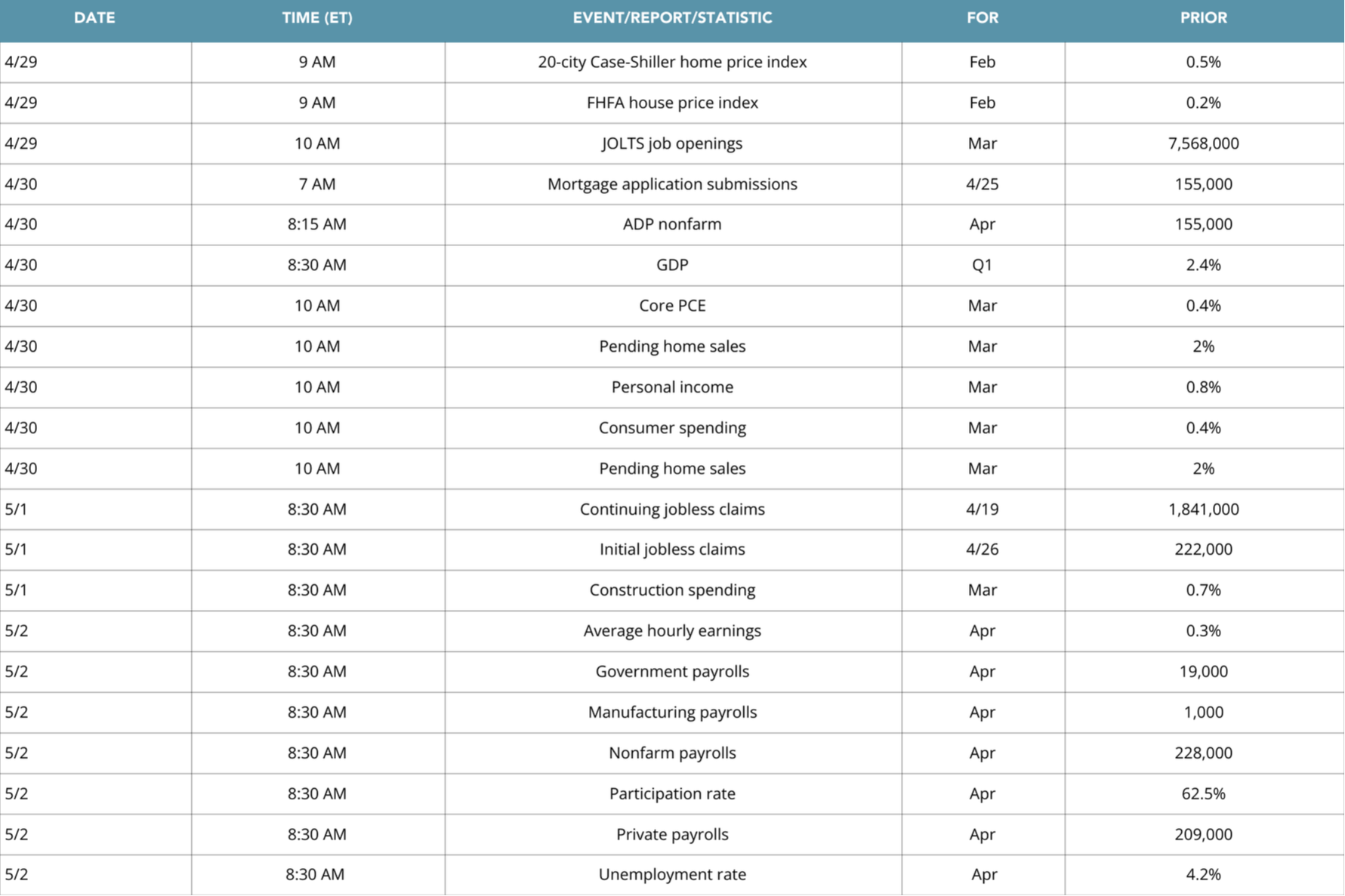

This week’s important economic reports include:

|

||

WEEK OF MAY 25, 2020 |

||

|

||