Market Movement – June 15,2020

|

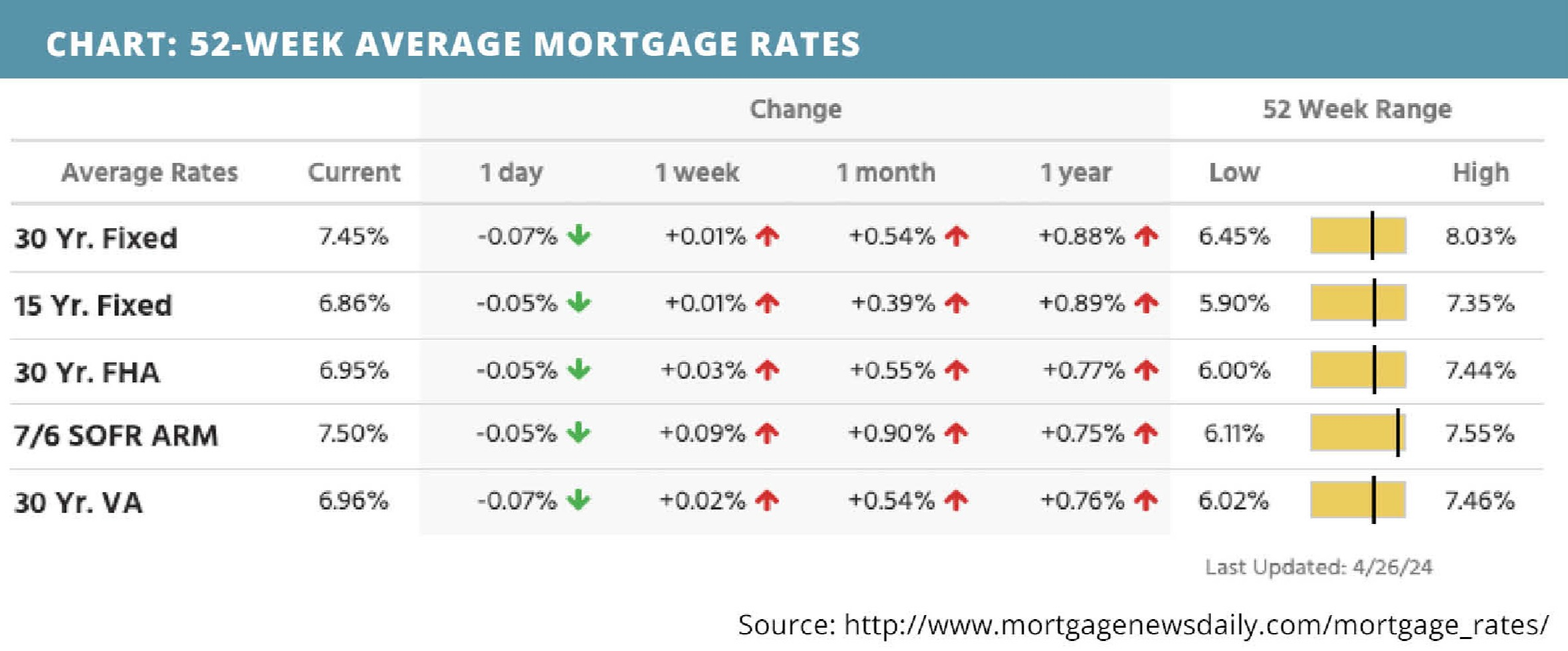

| The Federal Open Market Committee (FOMC) voted to leave the benchmark interest rate unchanged this week, and mortgage rates trended lower. Small-business optimism is starting to improve as states and cities lift stay-at-home restrictions and move into recovery. Job openings declined in April, though the data lags by one month. Both new purchase and refinance mortgage application submissions increased. The consumer price index declined. Jobless claims are starting to decline. Consumer sentiment improved. |

|

MORTGAGE RATES CURRENTLY TRENDING

THIS WEEK’S POTENTIAL VOLATILITY

|

|

|

|

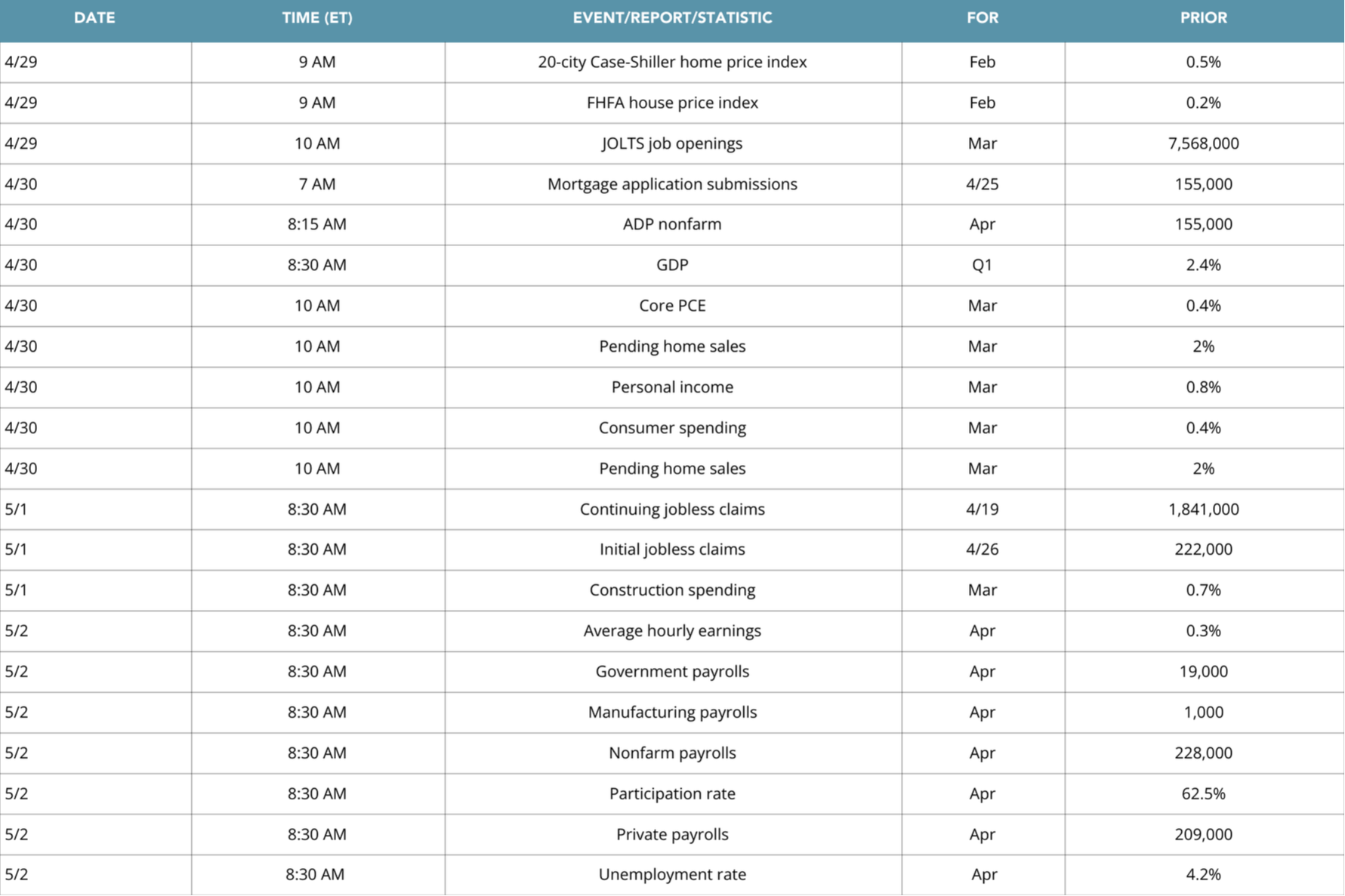

This week’s important economic reports include:

|

WEEK OF JUNE 15, 2020 |

|