Market Movement – June 1, 2020

|

||

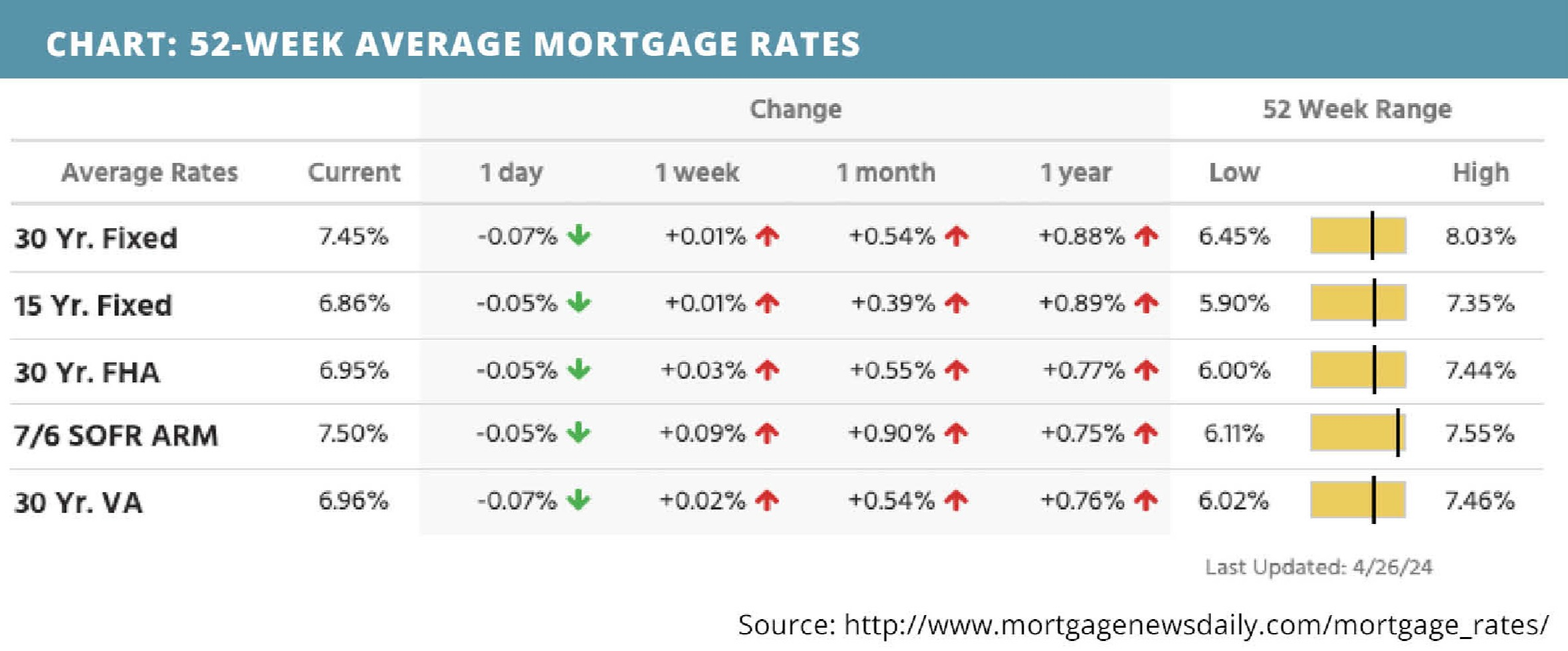

| Mortgage rates have not moved significantly this week and are still historically low. Home price appreciation has continued at a sustained pace. Consumer confidence improved. New home sales unexpectedly increased. New purchase mortgage application submissions increased, and refinance application submissions declined. The Federal Reserve released its Beige Book from its last semiannual monetary policy meeting. The weekly jobless claims report continues to reflect widespread unemployment. Gross Domestic Product (GDP) growth declined. Personal incomes jumped but consumer spending declined. The consumer sentiment index turned around. | ||

|

MORTGAGE RATES CURRENTLY TRENDING

THIS WEEK’S POTENTIAL VOLATILITY

|

||

|

||

|

||

|

||

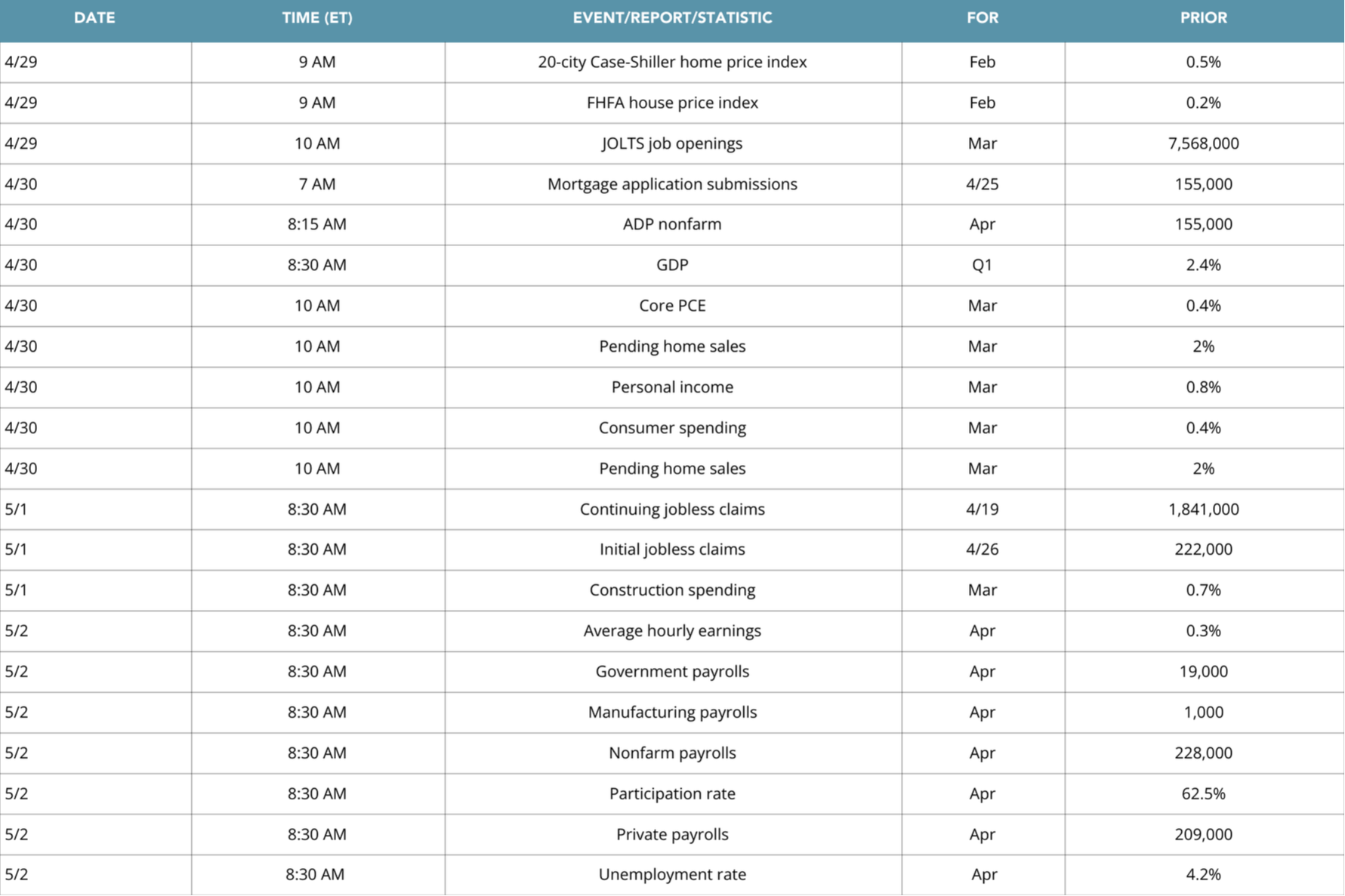

This week’s important economic reports include:

|

||

WEEK OF JUNE 1, 2020 |

||

|